Hired and Non-Owned Auto Coverage (HNOA)

What is this for? Why is this necessary?

Do you have employees drive their own car on behalf of your business? Before you say no, do you ever have someone…

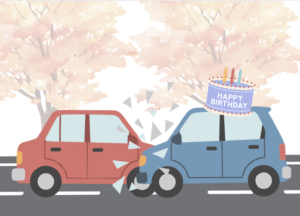

- Pick up a birthday cake

- Grab some needed office supplies

- Drop off or pick something up for the business

What if the employee gets into a serious accident while picking up treats for an office party? In most scenarios, the employee’s auto insurance will respond. Your employee may not have personal auto liability insurance limits high enough to cover the claim. Also, when the injured party realizes that your employee was on a work related trip, it is very likely that your business will also be sued.

Non-Owned Auto Coverage can protect your business in situations like this. The premium is usually very reasonable, and the coverage can often be added to your General Liability policy when you have incidental exposures like those above.

If your business owns vehicles or has employees transporting patients, a different auto policy is needed.

InsureGen can help you determine the coverage that addresses your situation.